unemployment insurance tax refund

Can I deduct unemployment insurance. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

208 3346301 Or mail to.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Tax form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received unemployment insurance UI benefits for the prior. Name A - Z Sponsored Links.

UI Compliance Bureau Idaho Department of Labor 317 W Main Street Boise ID 837350760. The IRS has sent 87 million unemployment compensation refunds so far. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

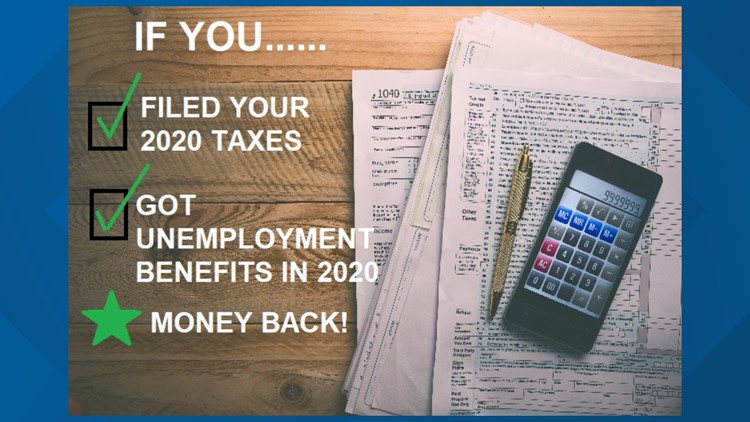

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The Capital IRS Tax Group. The IRS has been issuing refunds since May and has returned over 10 billion to over 87 million people so far the agency says.

Government Offices State Government. File Wage Reports Pay Your Unemployment Taxes Online. Fort Lee NJ 07024 201 308-9520.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. This is the fourth round of UI tax refunds the. COVID Tax Tip 2021-87 June 17 2021.

Contributions to a state unemployment. Notice for Pandemic Unemployment Insurance Claimants. Get in Touch.

Irs Tax Refund in Piscataway NJ. Return completed and signed form to the UI Compliance Bureau by fax. For any Unemployment Insurance Tax questions please contact the UI Operations Center at 1-877-664-6984 Monday through Friday 800 am.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information. Effective July 27th 2021 you will no longer be able to file a new PUA claim through this portal. This is the fourth round of refunds related to the unemployment compensation.

Submitting this form will. 60 N Taylor Ave. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441.

State of Ny Asmblymn Unemployment Insurance Tax Services. Generally you can deduct premiums you pay for the kinds of insurance used in your business. If an individual refuses an offer of work because unemployment insurance pays more than their weekly wage is asking to be laid off or requests to have their hours reduced so they can.

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Update Most Unemployment Benefits Won T Be Taxed Irs Will Issue Automatic Refunds Komo

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

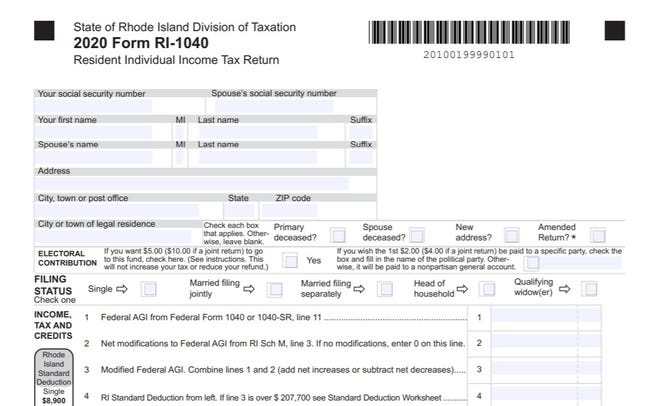

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com